Sentinel buys into agriculture for $22.8m

February 22, 2016

Matthew Cranston | The Australian Financial Review

Sentinel Property Group, which has $1 billion worth of office buildings and shopping centres under management, is buying its first agricultural property – a chicken farm for $22.8 million.

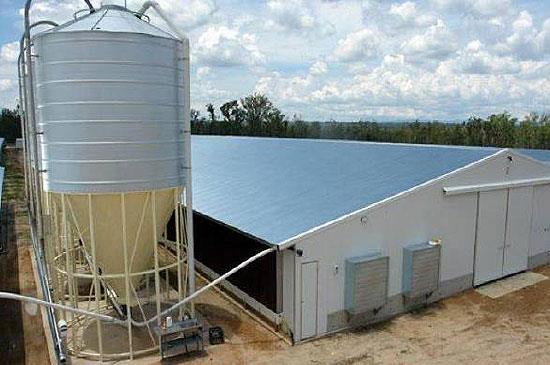

The Brisbane-based Sentinel, established by real estate investor Warren Ebert, will buy Purga Breeder Farms south of Ipswich and is forecasting a 12 per cent return per year. In an information memorandum for the Sentinel Income Trust obtained by The Australian Financial Review, Purga Breeder Farms will be purchased on a loan-to-value ratio of 50 per cent and will be leased to iconic producer Steggles until 2026.

Mr Ebert declined to comment on the deal, which comprises the purchase of three farms covering 63 hectares and 17 poultry breeding facilities. The property has a capacity for 200,000 birds and is owned by the Sanday and Trevanion families.

The deal comes only days after listed specialist Tasmanian newcomer TasFoods made a $12.5 million friendly offer for local family-owned chicken-farming business Nichols Poultry. Conditions have remained largely favourable for the poultry meat farming industry over the past five years with per capita consumption growing.

Sentinel, which has bought Woolworths and Coles-anchored shopping centres around Australia, has persistently topped the Property Council of Australia Investment Property Databank index backed by Morgan Stanley Capital International.

Investors who are supporting Sentinel’s push into the agricultural space said they liked the Purga farm deal because of the strength of the tenant, the strong forecast returns and the reasonable fee structure that Sentinel will derive from the investment. Fees include an acquisition fee of 1 per cent and a due diligence fee of 0.5 per cent of the purchase price of Purga Breeder Farms. There is also a structure for performance fees and a management fee is set a 0.93 per cent per annum of the total farm value.

The Sentinel information memorandum said it was able to secure the property at a passing initial yield of 11.50 per cent which it said compared favourably to other commercial property assets available in the market, which are showing general yield ranges of 6.5 per cent to 8.5 per cent.

“The strength of the tenant and favourable lease terms reinforce the security and stability of the income and further emphasis the opportunity.” Sentinel has sought to raise just over $14 million from investors. Sentinel also noted in its offer that an available interest rate of between 4 per cent and 4.15 per cent per year could be used.

Download the Article