Sentinel’s $4.5m buy… Investment firm’s Darwin portfolio climbs past $115m

June 23, 2021

LEADING interstate property investment firm Sentinel Property Group has boosted its Darwin portfolio splashing out $4.5m for a prominent Stuart Highway retail centre at Berrimah.

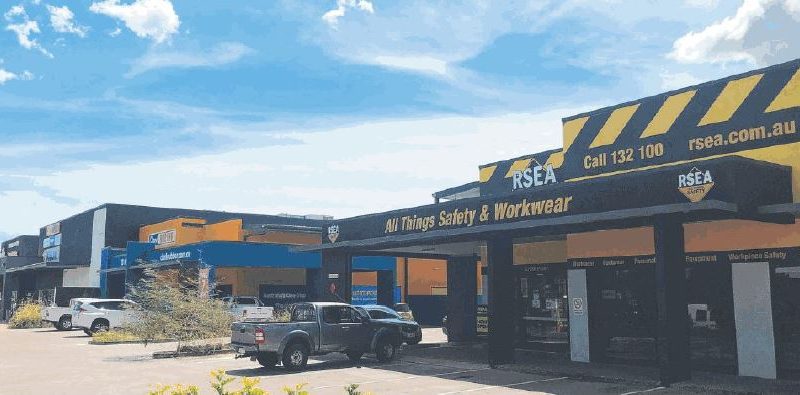

The property is leased to RSEA Safety and Clark Rubber and has a 48m highway frontage and covers 3,280 sqm.

The Brisbane-based Sentinel has a $1.2 billion property portfolio and is known for its strategic property purchases and hands-on asset administration.

The company has more than $110 million already invested in Darwin and has indicated it wants to grow that substantially.

Sentinel Property Group owns CasCom Centre and late last year spent $3.6m renovating the property.

Sentinel executive chairman and chief investment officer, Warren Ebert, said Sentinel had great confidence in the economic future of the Northern Territory.

As evidence of that he pointed to its Darwin purchases of Jacana House, a prominent office building in the Darwin CBD, Arnhemica House in Parap and the CasCom Centre Business Park at Casuarina in Darwin’s north.

Leading interstate property investment firm Sentinel Property Group has boosted its Darwin portfolio splashing out $4.5m for a prominent Stuart Highway business site at Berrimah. The property is leased to RSEA Safety and Clark Rubber. Picture: Supplied

Sentinel spent $34m buying CasCom in 2016, $60.74m for Jacana House in Woods Street, and $9.3m for Arnhemica House.

Mr Ebert said Sentinel is focused on acquiring established buildings, particularly offices, with a high yield between 8 and 9 per cent.

“Sentinel has been looking at more acquisitions in Darwin and the retail centre in Berrimah was an exceptional opportunity to buy a showroom/warehouse with national tenants offering outstanding returns,” he said.

“We have more than $110 million already invested in Darwin and we think the Northern Territory has an enormous next decade ahead of it.”

The latest acquisition at Berrimah, which was built in 2014. It features a net lettable area of 1,560 sqm with net passing annual income of $382,542 and a weighted average lease expiry (WALE) of 2.47 years.

“The asset is strategically positioned on the southern gateway to Darwin’s future population growth regions,” Mr Ebert said.

“It is located in a large format retail zone off the main highway in a strip featuring other large format retailers including Harvey Norman, Amart Furniture and car dealerships.”

Established in 2010, Sentinel has a national portfolio of more than 55 retail, industrial, office, land, tourism infrastructure and agribusiness assets.